Hero — The Future of Banks in Southeast Asia

Hello Everyone, hopefully review of this HERO project can be your reference and I am realy excited about this project. Because HERO is one of the hottest new ICO’s on the market right now from the looks of things and I think this project will rise to the top and stay at there to the moon. Why I am talking like this? Let me tell that :

What is a Hero?

Hero is the future of banks that provide loans with guarantees to uneducated and unbounded consumers throughout Southeast Asia. With the launch of a crypto unit called Hero Token, HERO intends to expand into a blockchain-based, no-load loan. Supported by venture capitalists such as Softbank, Alibaba and 500 Startups, the organization began operations in the Philippines in 2015 and has since helped thousands of Filipinos gain access to affordable credit.

We are introducing HERO, the future of banking in which He will provide secured loans to unbanked and underbanked customers in Southeast Asia. With this token sale, Hero intends to develop into a blockchain / blockchain-based uncollateralized loan-based unsecured loan. Supported by venture capital companies such as Softbank and Alibaba which they share the same vision with us. Our organization, PawnHero has started operations in the Philippines since 2015 and by then, we have helped thousands of Filipinos gain access to more affordable credit.

Below is a video, Introducing the Hero Capital Market Platform :

Our Current Product

Mission and Vision

Hero's mission is to revolutionize the banking industry to make credit more readily available and affordable for the unbanked or underbanked starting in Southeast Asia.

- Since 2015, we've helped thousands of Filipinos access short-term credit and that number is growing fast. As a pioneer in

- Online lending in Southeast Asia, we have become one of the most distinguished Fintech startups to disrupt the highly

- Entrenched, multi-billion dollar lending industry. Through our platform, we are already providing a revolutionary solution to a significant problem among the unbanked and underbated across emerging markets.

Headquartered in Singapore, we operate online with no branch infrastructure, allowing us to keep operating costs low and to stay focused on our customers. We are transforming lending into a frictionless, transparent, and highly efficient digital experience for Southeast Asia.Our vision is to disrupt the current financial system that excludes 2 billion people from the banking system by leveraging technology to create a more inclusive system that allows people access to credit.

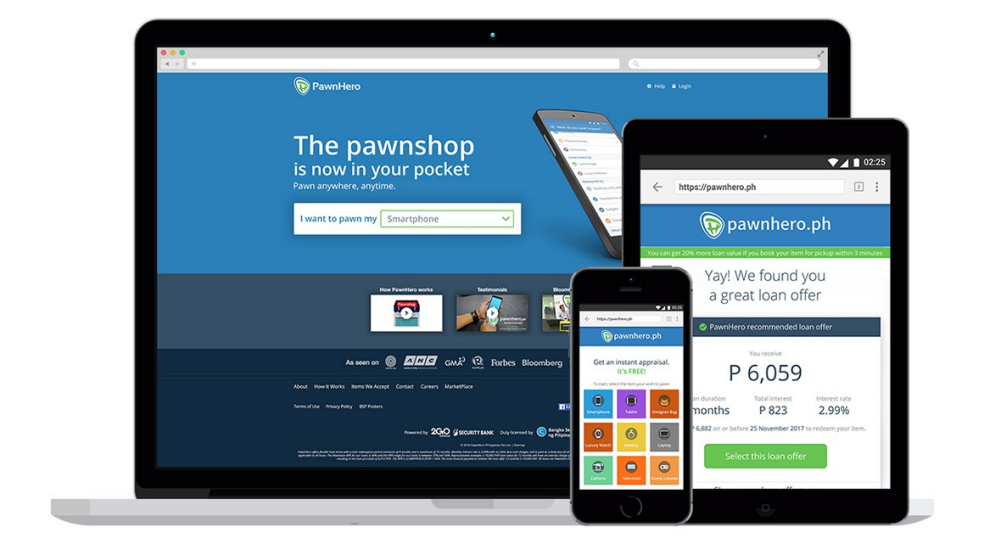

How It Works

Pawnshop in Everybody’s Pocket

PawnHero disrupts the traditional pawnshop experience by providing a hybrid virtual and physical service. The PawnHero operating platform (“Opus”) combines a seamless frontend customer experience with backend operational processes allowing PawnHero to manage and control the customer experience and the business.

The customer submits item information (“Requests”) at pawnhero.ph through their phone or desktop computer. After the customer submits their item details through a series of drop down menus, Opus links the request to our Magnus Loan pricing model which instantly delivers several loan offers with different loan maturities to the customer. The customer then selects their preferred loan offer and is guided through Customer Information, Payment Method, and Delivery modules.

Opus then arranges for a PawnHero motorbike courier (“PawnTrooper”) to pick up the item from the customer’s home at no charge to the customer. At the time of pickup, the PawnTrooper completes the legally required Know Your Customer (KYC) procedures, issues a pawn ticket to the customer, and receives the item for delivery to our Operations Center.

At the Operations Center, our expert appraisers authenticate the item and assess the condition of the item. If the item authenticity is confirmed and the condition of the item is as represented in the Request, then the loan is released through Opus to the preferred pay-out option selected by the customer. If the item inauthentic, then the item is returned to the customer and the customer is charged a 100 pesos (USD 2) delivery fee. If the item is authentic but not in the condition represented in the Request, then the appraiser estimates the revised value of the item and Opus delivers a new loan offer via SMS and email to the customer. If the customer accepts the revised offer, then the loan is released through Opus to the preferred pay-out option selected by the customer. If the customer declines the revised offer, then the item is returned to the customer at no charge to the customer.

PawnHero stores the pledged items at the Operations Center in a secure and environmentally controlled centralized vault. Opus tracks the movement of the pledged items throughout the process until the items is either returned to the customer upon redemption by a PawnTrooper or the item is sold.

Upon or prior to the maturity date of the loan, the customer may, through various payment options, make the loan redemption payment or apply for a loan renewal. If the customer fails to redeem or renew prior to the maturity date, then the loan enters a legally required notice period of between 1 month for electronics and up to 3 months for non-depreciable items. Upon the completion of the notice period, if the customer has not made the required redemption and payment of additional interest due, then Opus completes the legally required public notice and auction process and then makes the item available for sale in our marketplace.

PawnHero offers multiple payment options for the loan release (“Pay Out”) and the loan redemption and/or loan renewal (“Pay In”). Primary payment partners include Paynamics, which offers multiple over the counter transactions at banks nationwide, and Pay In and Pay Out at various retail locations including leading convenience stores such as 7/11 and other retail locations across the Philippines.

We partnered also with a blockchain-enabled platform that enables anyone, including those without bank accounts, to easily access financial services directly from their phone. Using Coins, customers have access to a mobile wallet and services such as remittances, air-time, bill payments, and online shopping at over 100,000 merchants who accept digital currency. Another option includes cardless ATM withdrawal. PawnHero continues to add Pay Out and Pay In options with leading Philippines companies in the banking, money transfer, e-wallet, digital money, and retail processing location businesses.

Blockchain Technologies

Blockchain technologies are well known as the disruptive technology, possible to perform in lot of segment, including the finance industry. Hero platform will provides collateralized loans to the unbanked or under-banked consumers across the South East Asia.

The platform was blockchain based technology. Since 2015, the platform has become the first fully licenced online pawnshop in Asia. With the platform, have helped thousands of the Philippines people to get short-term access credit. By the blockchain technology, it will create a more inclusive system to disrupting the finance system. By allowing people to get an easiest access to credit.

In Hero platform, the transaction will be recorded on the blockchain. There is also a reputation system taken from a repayment so user will able to improve their reputation. The platform was using Ethereum blockchain and smart contracts. By the Ethereum smart contract, it will represent the basic pawnshop principle.

The main benefit by using the blockchain technology is, because the platform able to reduce the manual reviews, data re-entry and also the system reconciliation. Distributed ledger will also reducing the risk, and increase the transparency.

Blockchain Benefits

How can the blockchain begin to have real meaning in the lives of the two billion excluded individuals around the world?

Blockchain could be the solution. First, this technology represents a powerful new tool for improving financial inclusion, potentially disrupting many financial institutions and enhancing the performance of banks in the global economy. By disinter-mediating traditional lending institutions and radically simplifying processes, blockchain can finally enable instant, frictionless loans, so that people don’t wait in line for an hour or more, travel great distances, or risk life and limb venturing into dangerous neighborhoods at night just to get a loan.

Blockchain could be the solution. First, this technology represents a powerful new tool for improving financial inclusion, potentially disrupting many financial institutions and enhancing the performance of banks in the global economy. By disinter-mediating traditional lending institutions and radically simplifying processes, blockchain can finally enable instant, frictionless loans, so that people don’t wait in line for an hour or more, travel great distances, or risk life and limb venturing into dangerous neighborhoods at night just to get a loan.

Second, it will imp Second, it will improve administrative accountability. If micro-loans are recorded to the blockchain and everyone can access them, then they can hold those more accountable for bad behavior. Blockchain as a technology, has the potential to address all these innate intricacies of the lending process. With the inherent concept of open ledger, decentralized platform, smart contracts and integrated central database, blockchain achieves transparency, cost effectiveness, regulatory compliance and risk analysis in the lending process.

By reducing manual reviews, data re-entry and systems reconciliation, the system provides the company with immediate cost savings. Loan data processing can be done exclusively on the distributed ledger reducing risk and increases transparency and responsiveness, the technology itself functions like a regulation.

Blockchain technology creates a whole new set of business models previously unimaginable, like Hero, that empowers individuals and businesses alike.

Competitors

Banks are very binary - yes or no. They do not have the gray and you may have 9/10 of the requirements, but they are still high risk and Will have zero access to a loan. We want to make sure that the other factors in someone's life count when it comes to giving them access to credit.

Aside from that loans can take up to 20 days to go through the approval process of a bank, our technology could reduce this to a fraction of the time by using machine learning techniques to build predictive algorithms.

What is hero token?

HERO is built as an ERC20 token on the Ethereum blockchain and is identified through the ticker symbol Hero.

The token sale is an event in which the crypto-currency project sells part of its tokens to early adopters and enthusiasts in exchange for funding.

The Hero Token enables the community to participate in PawnHero’s success story, rather than limiting it to a small, selected number of traditional venture capital funds. By issuing Hero tokens, tokenholders will benefit from PawnHero’s future success. A token sale is fast, transparent and efficient for exactly this purpose.

Even in the age of technology, about 40% of the global population, lacks access to primary financial services and affordable credit. Despite making our economy globally sound, the financial services industry fosters with problems that make it more distanced from the people. Financial institutions do not give services to the unbanked as they are simply unprofitable or too risky to serve. However, because of their monopoly in developing economies, many of them have no incentive to improve products and consumer experience, increase efficiency or appeal to the coming generation of customers.

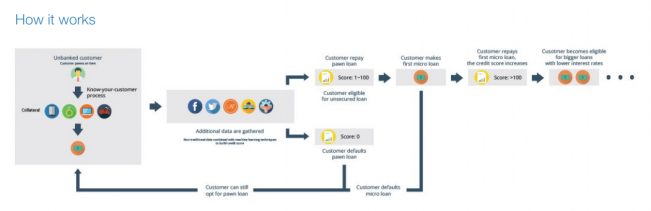

Hero Token (Symbol HERO) - The Future of Banking in Southeast Asia

The amount of tokens that are created for the Hero chain are all dependent on how many coins are sold during the token sale. a maximum of 250,000 Ethereum (ETH) tokens will be accepted for the purchase of Hero tokens in this token sale. The maximum amount contributed will in turn represent 80% of all Hero tokens. Since we don’t know the total that will be sold, the token sale operates based off of percentages to ensure fairness for all. Should the maximum amount be reached prior to the end of the sale on TBD, which is 4 weeks after the start of the token sale, we will cut off the token sale. In the event that such maximum amount is not fully funded by the end of the token sale, the percentage of 80% of all tokens will be adjusted accordingly, with the difference between such lower amount and the maximum amount being reserved for future token sales.

The amount of tokens that are created for the Hero chain are all dependent on how many coins are sold during the token sale. a maximum of 250,000 Ethereum (ETH) tokens will be accepted for the purchase of Hero tokens in this token sale. The maximum amount contributed will in turn represent 80% of all Hero tokens. Since we don’t know the total that will be sold, the token sale operates based off of percentages to ensure fairness for all. Should the maximum amount be reached prior to the end of the sale on TBD, which is 4 weeks after the start of the token sale, we will cut off the token sale. In the event that such maximum amount is not fully funded by the end of the token sale, the percentage of 80% of all tokens will be adjusted accordingly, with the difference between such lower amount and the maximum amount being reserved for future token sales.

Token Details :

- Ticker: HERO

- Token type: ERC20

- ICO Token Price: 1 HERO = 4.68 USD (0.00500 ETH)

- Fundraising Goal: 187,300,000 USD (200,000 ETH)

- Sold on pre-sale: 6,149,949 USD

- Total Tokens: 50,000,000

- Available for Token Sale: 80%

Value to Investors

Hero are strategically designed to add value to the Hero network :

- Reward bearing tokens - like a interest

- Social impact of helping underserved access affordable credit

- Buy back: The company may use a percentage of profits to repurchase Hero tokens from the open market at the

prevailing market price, therefore the value of the token should be further positively correlated to the success of the

project.

There is no risk of interest default on pawn loans granted by PawnHero. PawnHero withholds the entire interest due over the term of a pawn loan up front by deducting the interest from the proceeds credited to the customer. As an example, a 1,000 Philippine Peso (PHP) loan with a 3 month term and a monthly interest rate of 2.99% would earn 89.7 PHP of interest. PawnHero only releases 910.3 PHP to the customer and thus collects the full 89.7 PHP of interest with no risk of interest default. After the 3 month term of the loan, the customer is required to redeem the loan by paying 1,000 PHP. Depending on the underlying collateral PawnHero offers the customer to renew the loan at which point additional inte renew the loan at which point additional interest is due. Investors receive 20% of the interest collected. So that is the 20% of 89.7 PHP. For the quarterly respectively monthly distribution of interest, the sum of all loans released within the period are used.

To participate in the Hero token sale you can send the following currencies from a wallet you directly control (do not send from

an exchange) to the Hero wallet.

an exchange) to the Hero wallet.

- Ethereum (ETH)

- ETH Classic

- Bitcoin (BTC)

- Ripple

- LiteCoin

- Waves

The wallet address will be made available on our website www.herotoken.io before the actual token sale. Hero token will be delivered to the purchaser after the end of the token sale. Transferability will start from the first day of trading, which is planned to start after the token sale ends in September. After this token sale, no additional Hero tokens will be created.

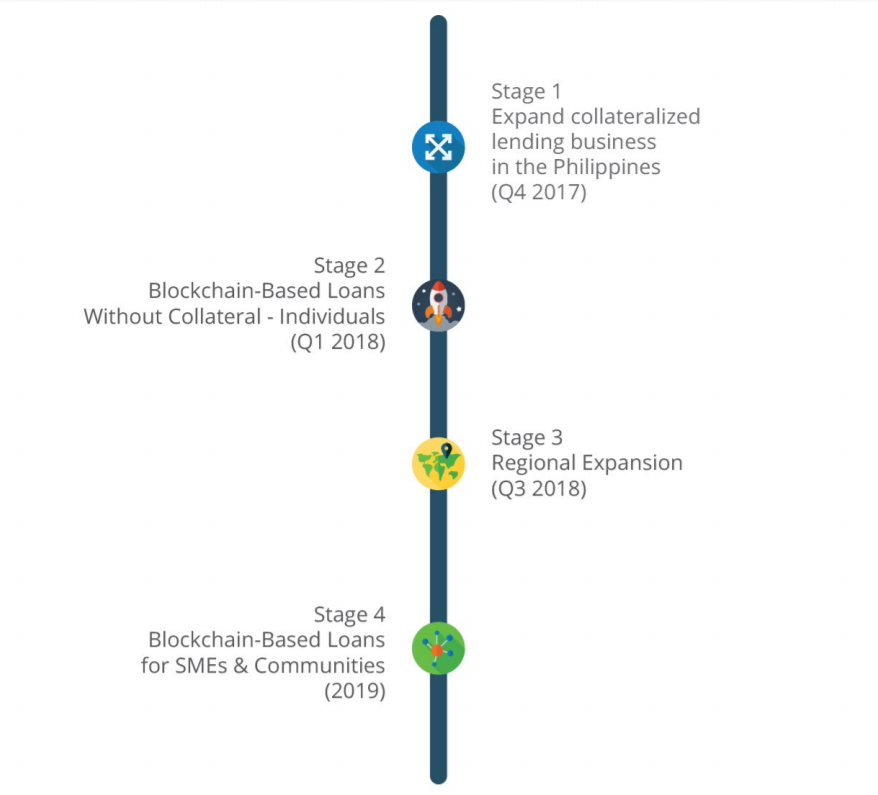

Road Map

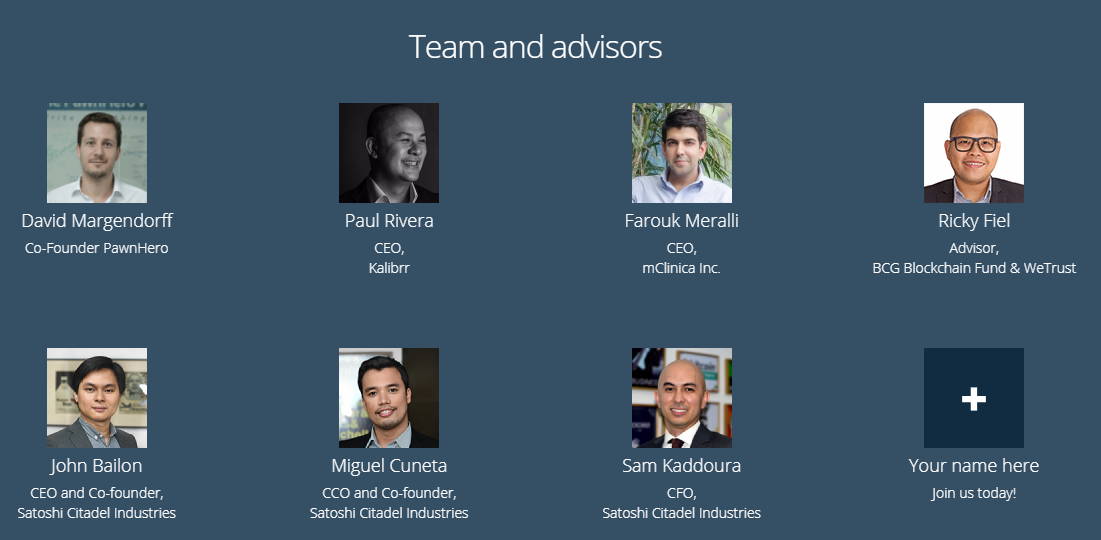

Team & Advisor

For more detailed information about the project and the conditions of participation in this ICO, I recommend to visit the links below:

- Website : https://www.herotoken.io/

- Whitepaper : https://s3-ap-southeast-1.amazonaws.com/herotoken/Hero+Whitepaper_080817.pdf

- Bitcointalk ANN THREAD :https://bitcointalk.org/index.php?topic=2073049

- Facebook :https://www.facebook.com/PawnHero.ph

- Twitter :https://twitter.com/PawnHeroPH

- Slack :https://herotoken.herokuapp.com/

- Telegram : https://t.me/herotoken

Profile bitcointalk : https://bitcointalk.org/index.php?action=profile

ETH : 0xd3c9e8608103cf2c8b153c8d7404fc5b563d9470

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar