TOKENLEND - Complete Loan Service For All Parties

Firstly, it guarantees loans for all of us, which will give people the ability to invest in guaranteed real estate loans in different currencies and currencies. Our foundation will eliminate the uncertainty facing small investors by helping them build a predictable, predictable, and profitable competitive loan portfolio. consistent.

Ideas for TokenLend results from their investment experience and software development. The goal is to build a solid and reliable ecosystem that provides adequate capital for all

The Foundation will have a carefully selected list of secured loans that have been paired for investment readiness. TokenLend only receives loans from trusted EU creditor. The presence of a legal entity as a partner will enable us to take the necessary precautions in advance to receive timely loan payments and minimize the risk of default. TokenLend employees will confirm information received from the borrower, including personal information of the borrower, mortgage information, appraisals and LTV rates. The loan will only be listed if it meets TokenLend tight credit selection criteria. Information about the project can be viewed through the following channels facebook: https://www.facebook.com/tokenlend/ twitter: https://twitter.com/Tokenlend_news

A friend in need is a friend indeed. We all have been in tough situations in our lives and asked for help from our dear ones. Banks fulfilled the task of helping out in our financial life problems. You needed a safe place to deposit your savings and Bank was there for you. You needed money during an emergency and Bank was there for you. But, all these services of the banking and financial institutions came with a lot of problems. The people who need the basic financial and banking services are still far behind in getting one. The people who need loans are still filling out some form somewhere or making rounds to search the right person, who can help him get the loan from the banks.

The bureaucracy involved in the process made thing much worse. People could not help themselves during emergencies and it has become global phenomena. The loan marketplace is full of such stories where the big corporates and business house have it easy while a common man has to find way and means to utilise the services. The chain of intermediaries in the banking and financial services have created a vicious cycle of corruption which is exposed from time to time but yet no alternative is guaranteed.

Solution Offered

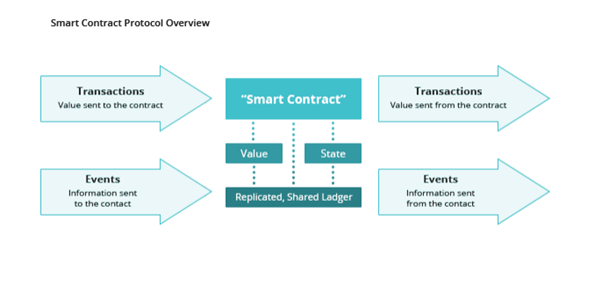

TOKENLEND is working on the same problem and has brought an innovative Lending platform based on the blockchain technology. The Online lending marketplace is created where people can borrow money without the need of any third party. Investors can find secured loans to invest in the lending marketplace which are carefully chosen from across the globe.

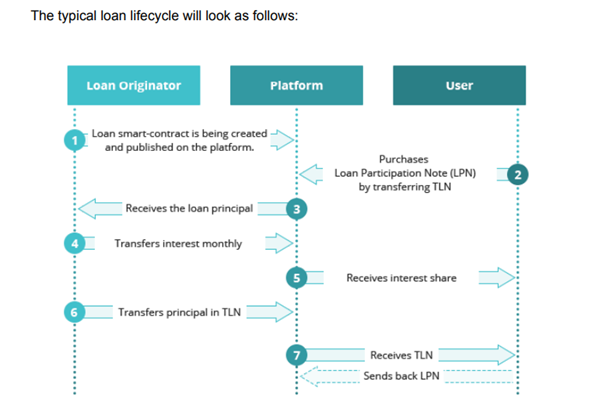

A Loan Participation market also exists on the platform for creating immediate Liquidity. The smart contract is utilised to create secure and transparent loans on the platform in which anyone from around the world can invest.

ICO INFORMATION and Team

To create the platform, they are conducting an ICO. The total tokens created for the Project are 473,466,667 TLN. 75% of the total tokens are available for the ICO. People can participate in the presale from 1st March 2018. The main ICO of the Platform begins from the 26th March 2018 and continues for 45 days.

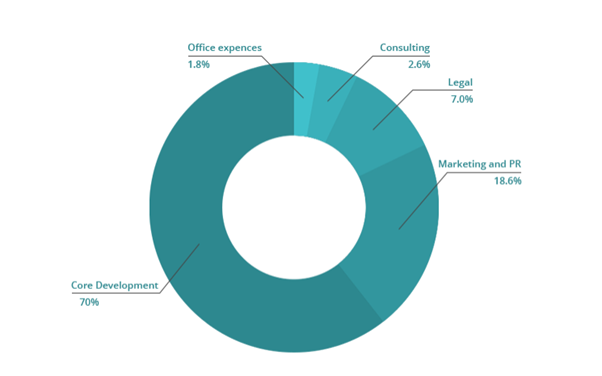

The funds will be utilised for the core development of the platform. The people behind this project are experienced investors, analyst and IT experts.

The funds will be utilised for the core development of the platform. The people behind this project are experienced investors, analyst and IT experts.

Conclusion

The Blockchain technology is here to make thing secure and transparent. They have taken one of the biggest problems we face in our financial life. Currently, they are focussing on the European Countries and believe that market is ready for the platform like TOKENLEND. Utilising Real estate as the security for the loans originated on the platform is one of the key advantages of the platform. I think what they are offering is a peer to peer loan ecosystem built on blockchain technology, which could revolutionize the lending economy.

In future, they will be expanding to the Non-EU Countries to generate Secured loans on the platform. Their stringent criteria to accept the authentic borrowers will reduce the numbers of loan default on their Platform. The Question is are we ready to accept TOKEN LEND Platform as an investment tool to generate profit? There is going to be exciting times ahead in the Economy as we have a new investment option in the market. So are you ready to earn interest on your assets.

For More Information :

Website : https://tokenlend.io/

Profile bitcointalk : https://bitcointalk.org/index.php?action=profile;u=1901918;sa=forumProfile

ETH : 0xd3c9e8608103cf2c8b153c8d7404fc5b563d9470

Komentar

Posting Komentar