OPTITOKEN

Algorithmic trading is a technique of executing a large order (too large to fill all at once) using automated pre- programmed trading instructions accounting for variables such as time, price, and volume, to send small slices of the order — technically called child orders — out to the market over time. They were developed so that traders do not need to constantly watch a stock and repeatedly send those slices out manually.

Algorithmic trading is not an attempt to make a trading profit. It is simply a way to minimize the cost,market impact and risk in execution of an order. It is widely used by investment banks, pension funds, mutual funds and hedge funds because these institutional traders need to execute large orders in markets that cannot support all of the size at once. this form of trading can also be referred as automated trading.

The vast majority have a hard time benefiting when trading digital currencies. This kind of trading is profoundly convoluted because of extraordinary instability and highly manipulative market. Newcomers with a lot of will and very few skills stand to lose a lot of money. A significant number of them are continually pursuing the crowd and following patterns of cost spikes sometime later, rather than the brilliant lead of purchasing low and offering high.

As an algorithmically traded cryptocurrency, holders of Optitoken will be exposed to 24/7 trading through code developed with the strategies used by professional traders in a portfolio of established and manually selected cryptocurrencies. The algorithm developed for this kid of trading takes advantage of price swings among a select group of tokens, known as “The Basket,” made up of a variable number of coin(s) deemed statistically or categorically undervalued. They will also be established and growth driven projects with high upside potential based on several factors based on past trends of growth and/or market averages. It will also take into account token supply and market capitalization.

What Is OptiToken?

OptiToken is an automated tokenized portfolio that claims to diversify your investments for maximum returns and minimized risk. When your money is held with OptiToken, you participate in algorithmic trading 24/7. Those algorithms make trades on your behalf based on their market analysis.

Overall, OptiToken claims to help anyone trade like a professional. The website explains that “most people have a very hard time profiting when trading cryptocurrencies.” Crypto trading is “highly complicated due to volatility and manipulation.” With OptiToken, investors can bypass these issues “by holding a token that exposes them to 24/7 algorithmic trading, developed with the strategies used by professional traders.”

Obviously, those are some bold claims. We’ve seen plenty of other companies describe how investors can get rich quick with their trading algorithms. Is OptiToken the real deal? Or is this yet another over-hyped fund? Let’s take a closer look at how it works.

How Does OptiToken Work?

You purchase OptiToken to “buy into” the trading algorithms. The value of each OptiToken comes from the value of the underlying fund.

Basically, the algorithm takes advantage of price swings among a select group of tokens in a basket. Algorithms will choose high growth coins, stable coins, undervalued coins, and coins with high upside potential long-term. Then, the algorithm will create profit from an ongoing series of trades, then deliver profits into OptiToken markets to provide constant upward price pressure.

Applying “constant upward price pressure” essentially means that OptiToken’s profits will be used to continuously repurchase tokens from the market. This means the value of OptiToken should continue rising – which is why it’s called a “hyper deflationary” currency.

Any OptiTokens purchased by the fund will be allocated for two purposes:

A small percentage will be devoted to the community supporting the infrastructure and further development of OptiToken

The larger remaining portion will be sent to an unspendable address to create strategic scarcity, preventing the tokens from re-entering the ecosystem as selling pressure. Any remaining OptiTokens held by the public gain value each time this cycle occurs.

Overall, 82% of profits will go towards rebuying the next targeted oversold coins in the basket to increase the fund. 16% will go towards buying OptiTokens from the market to create upward price pressure. 1% will go as payment to the community supporting the OptiToken infrastructure. And 1% will go to operating expenses.

OptiToken Features

OptiToken emphasizes all of the following features:

Diversity: OptiToken will hold a basket of “expertly curated and diversified” cryptocurrencies. You can own a proportional share of this basket by purchasing an OptiToken, which will be available for trading on major exchanges.

Algorithmic Trading: OptiToken won’t just hold and keep a basket of cryptocurrencies. The fund will be actively traded 24/7 using algorithms to generate higher returns.

24/7 Trading: Funds are traded around the clock.

Low Fees: OptiToken claims to offer low fees because of larger volume buy/sell orders, which means investors pay significantly lower fees than they would with a self-managed portfolio.

Buy Pressure: In every automatic buy cycle, a portion of profits created will be used to buy OptiToken from the open market, leading to upward price pressure.

Strategic Scarcity: A portion of tokens purchased back will be sent to an unspendable fund that will be verified transparently, creating strategic scarcity on the market. OptiToken claims to be the first project to use this strategy.

Transparency: OptiToken’s fund will be externally audited on an annual basis “and as needed” to verify integrity for token holders.

Who’s Behind OptiToken?

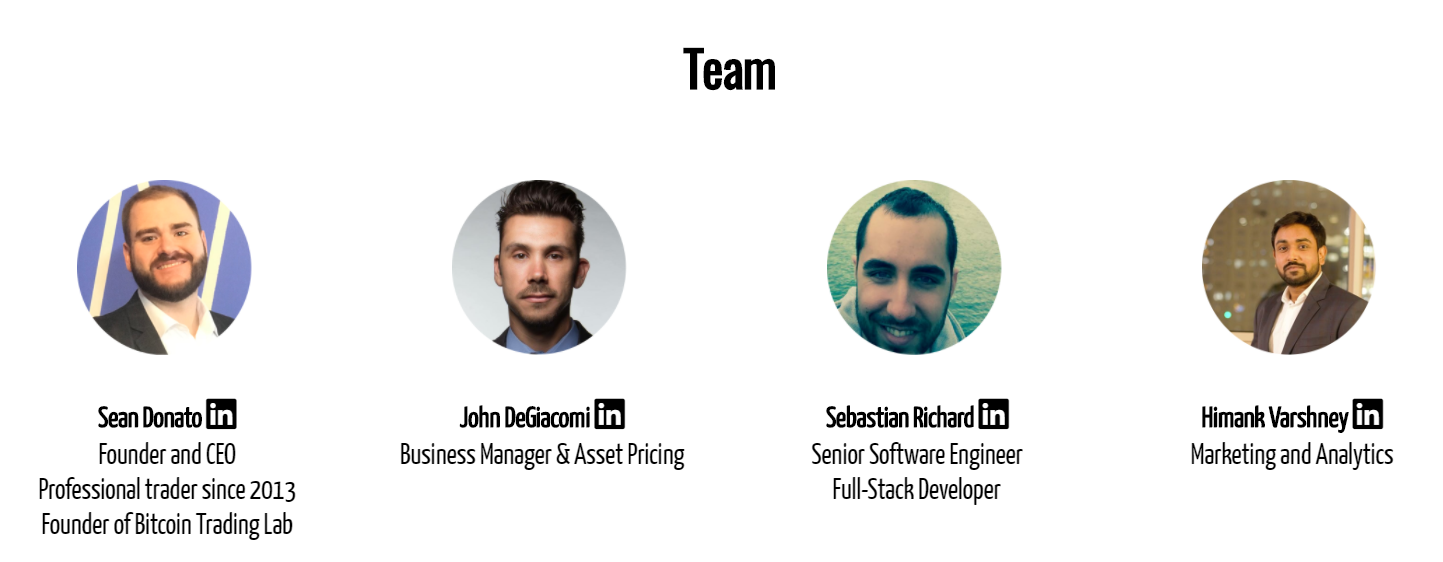

OptiToken is led by Sean Donato (CEO). Donato has been a professional trader since 2013, and he’s the founder of Bitcoin Trading Lab. Other key members of the team include John DeGiacomi (Business Manager and Asset Pricing) and Sebastian Richard (Senior Software Engineer).

The team launched the project in November 2017, with initial press releases launching in December 2017.

The beta is scheduled to launch in May 2018.

The OptiToken Token Sale

The OptiToken token sale, called an initial token offering or ITO, is scheduled for April 2018. The token sale will last for 90 days.

Further details about the token sale are not available at this time. However, OptiToken plans to begin promoting the token sale from March onward.

Team

Sean Donato

Founder and CEO

Professional trader since 2013. Founder of Bitcoin Trading Lab

John DeGiacomi

Business Manager & Asset Pricing

Sebastian Richard

Senior Software Engineer

Full-Stack Developer

Himank Varshney

Marketing and Analytics.

OptiToken Conclusion

FOR MORE INFORMATION :

Website: https://optitoken.io//

WhitePaper: https://optitoken.io/White_paper.pdf

Facebook: https://www.facebook.com/optitoken/

Profile bitcointalk : https://bitcointalk.org/index.php?action=profile;u=1901918;sa=forumProfile

ETH : 0xd3c9e8608103cf2c8b153c8d7404fc5b563d9470

Komentar

Posting Komentar